The duty rate can be found in Canada’s Customs Tariff by looking up the HS code. Duties are calculated in $CAD.

HS codes play an important role throughout the customs process therefore accuracy is very important.

The duty rate can be found in Canada’s Customs Tariff by looking up the HS code. Duties are calculated in $CAD.

HS codes play an important role throughout the customs process therefore accuracy is very important.

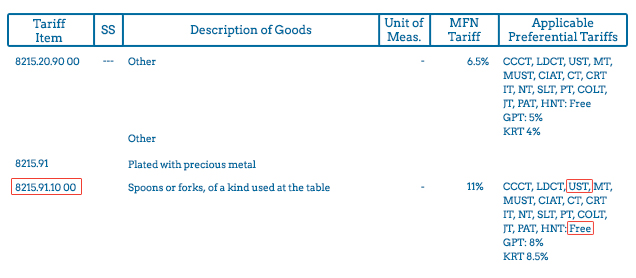

The following will help illustrate the duty rate for Stainless Steel Spoons. Below you will find the HS code for Stainless Steel Spoons in the Customs Tariff.

The HS code for Stainless steel spoon sis 8215.91.10.00, this is found under the column Tariff Item.

If you are working with a free trade agreement like NAFTA look under the colum Applicable Preferential Tariffs.

Duty rates are listed for specific countries using an acronym. For example, UST is United States of America. The US duty rate (UST) is listed as free for Stainless Steel Spoons, therefore no duties will be charged.

You need to determine the Value for Duty of your imported Goods. Value for Duty is the price you paid to purchase the goods.

You must be able to demonstrate to customs that he Value for Duty using some type of documentation. This can take the form of an invoice, agreement, cost allocation schedule or a receipt from the seller.

The duty rate is charged on the purchase price of your goods (value for duty).

5% GST on most imports into Canada

13% HST on most imports to Ontario, Nova Scotia, New Brunswick and Newfoundland

Exempt goods have to be marked on your import documentation.

For further information click on the link below.