Your BN is a simple method of identifying you and your business to the Government.

Every business has their own unique BN.

How to Obtain Your BN

Registration for a BN can be done online by Visiting Business Registration Online (BNO) as well as by mail, telephone (1-888-959-5525) or fax.

You can also obtain a BN through a Canada Revenue Agency Tax Centre, by mail or fax.

How Does the BN Work?

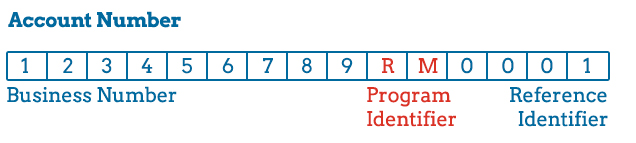

The BN is made up of 15 digits. The first 9 digits represent your business; this is your business account.

Once you have registered for a BN, you can register for additional accounts such as an import/export account.

Your additional account will make up the remaining 6 digits.

BN – The first 9 digits used to represent your business.

Program Identifier – Represents the type of account you want to associate with your BN, notice that the identifier for an Import/Export account is RM.

Reference Number – The number associated with your Import/Export Account.

There are 5 Major CRA Business Accounts

RT – Goods and Services Tax/Harmonized Sales Tax

RP – Payroll

RC – Corporate Income Tax

RM – Import/Export

RZ – Information Return

Why Register for an Import/Export Account?

It is necessary to export your good from Canada.

It is required to process your customs documents with the CBSA.

It is also required by the CRA for accounting and audits.

Who Can Use My BN?

As a business owner, you can give other access to use the BN on your behalf. This can be done using an online portal called Business Registration Online.

The CRA will provide you an ID and password to access Business Registration Online and add a representative.

A custom broker acting as your representative uses your BN number when filling out customs documents.